How Much Will Car Salesman Come Down in Price

NEWS

Inventory Shortage Leaves Little Room for Haggling; Here Are 5 Other Ways to Save on Your Car Purchase

Saving on a car purchase | Cars.com illustration by Paul Dolan

By Jane Ulitskaya

August 30, 2021

The same car-buying advice has been thrown around for ages: negotiate only on the price of the vehicle; walk away if it isn't right; buy a used car to save money and minimize depreciation. All of this was sage advice in pre-pandemic times, but the ongoing vehicle inventory shortage means common tactics may no longer work — at least for the foreseeable future.

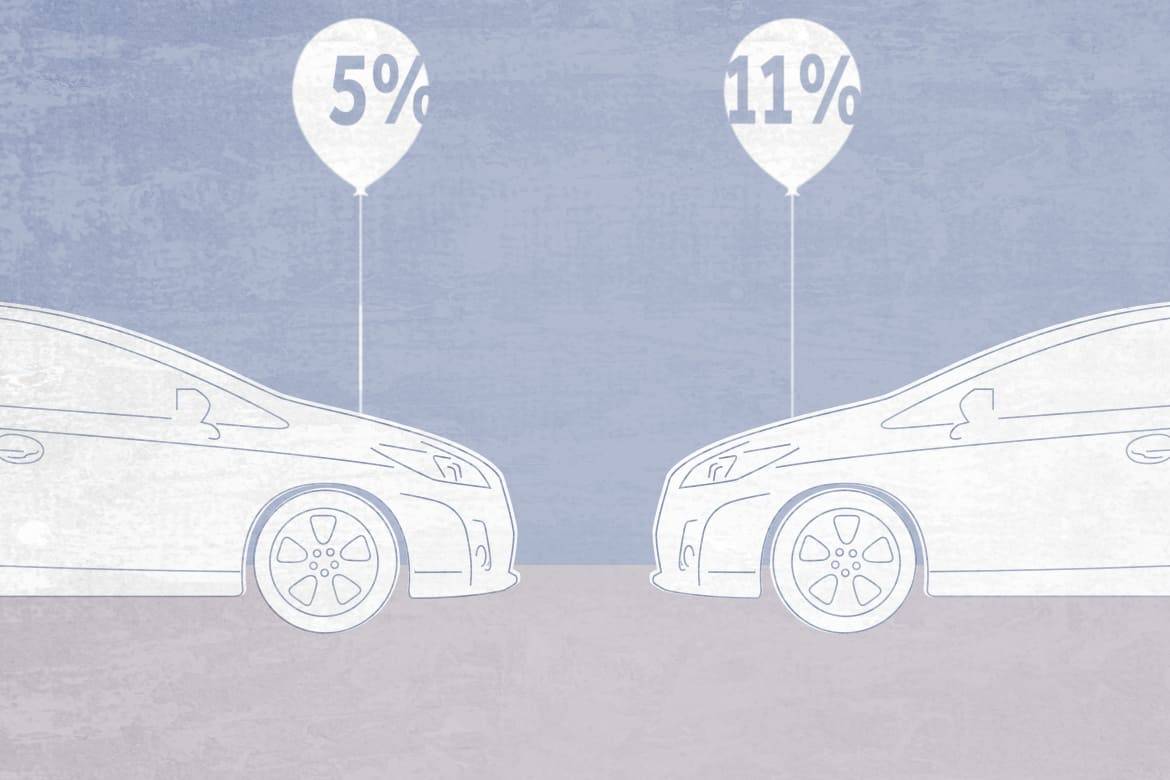

In the current inventory pinch, dealers are unlikely to come down much on the price of a vehicle. In July 2021, J.D. Power pegged the average discount on a new car at just 4.8% of MSRP, a record low, amid strained dealer supply. If you walk away from a car purchase, there's no guarantee that another dealership will have the vehicle in stock. Even buying a gently used car in lieu of a new one may not yield substantial savings, given used-car prices are hitting record highs.

Related: How Long Will the Vehicle Inventory Shortage Last?

For shoppers who can't postpone a purchase until the shortage improves, getting a good deal may sound like mission impossible. But proper preparation, flexibility and a few tips can improve your odds of saving dough even amid the chaotic market.

1. Take Time to Prep, Be Ready to Strike

Preparing for a vehicle purchase was important even before the chip shortage drained vehicle inventory. Today, it's absolutely essential because of dwindling vehicle supply, rising prices and reduced discounts. Budgeting correctly, researching nearby inventory and shopping around for automotive financing can offset some of the sticker shock (and stress) of buying a car during the current shortage.

Find the Best Deal

Tools like Cars.com's advanced search feature help shoppers locate affordable vehicles in the area. Expanding the search to similar vehicles from multiple brands or cross-shopping vehicle types can also lead to savings. Finding deals on in-demand pickup trucks and SUVs may be a challenge, as those vehicles are among the hardest hit by the inventory shortage.

Before getting your heart set on a specific make and model, it's wise to set a budget for the purchase and search only for vehicles that fall into your range. A car affordability calculator helps simplify the process.

Shop Around for Financing

Another way to save on a car purchase is by shopping around for the best auto loan from banks and credit unions. Shannon Bradley, an auto-loan expert at NerdWallet, says getting pre-approved for a car loan offers leverage to get a better rate at the dealership (more on that in the next tip).

"Pre-qualification or preapproval for an auto loan is strongly suggested," Bradley said. "It will help shape your expectations about what you can afford before you shop — that is not a calculation you should do within 100 yards of a shiny new car. If you walk into a dealership without an idea of the terms you might qualify for elsewhere, you won't know if you could have done better. A pre-qualified or preapproved offer gives the dealer numbers to beat."

If the Car Fits, Act Fast

Shoppers must strike a balance between taking the time to prepare and acting with urgency once they find the right vehicle. Jenni Newman, Cars.com's editor-in-chief purchased a used car this month, and she says shoppers must remain flexible in the current environment. It also pays to go with a lesser-known model, like her choice — a 2019 Hyundai Ioniq PHEV.

"In my case, my husband and I were looking for a plug-in hybrid after our car was totaled in a crash," Newman said. "After a couple weeks of test drives and false starts, we ended up buying a 2019 Hyundai Ioniq PHEV. We landed this car because we were flexible on the details — we knew we wanted a plug-in hybrid and a lot of safety features. Everything else was negotiable for us. Do we love the color? It's not our first, second or third choice, but we're in the process of falling in love with the car, its features and its incredible mileage."

In addition to staying flexible, Newman said shoppers should be ready to pounce when they find a vehicle that meets their needs. This means arriving at the dealership with a pre-approved car loan, checkbook and proof of insurance.

NerdWallet's Shannon Bradley concurs: "Show up prepared. Someone who can buy today is going to get a better deal than someone who says they will be back tomorrow."

2. Negotiate the Car Loan

Most shoppers know they can negotiate on a vehicle's price, but many aren't aware that the terms of the auto loan may also be up for negotiation. Dealerships are so tight on inventory right now that salespeople are unlikely to move much on the car's price. One alternative? Haggle on the loan instead.

According to the Consumer Financial Protection Bureau, negotiating on auto-financing terms can save shoppers thousands of dollars over the course of the loan term. Indeed, $35,000 financed over 72 months at 5% will cost $5,584 in total interest. Negotiate that down to 4%, and you're down to $4,426 — a savings of $1,158.

Car dealers are incentivized to source auto financing for the consumer because they typically get a small cut of the interest charged for the loan from the financial institution. The loan offered in the dealership isn't necessarily the best choice for the consumer, however. That's because the dealer is not required to offer the best loan terms — which is where negotiating skills can come in handy.

According to the CFPB, the negotiable parts of an auto loan include the annual percentage rate rate, length of the loan, prepayment penalty (the cost of paying off the loan early) and any additional fees associated with the loan.

It's also important to note that auto-loan interest rates are largely influenced by a consumer's credit score. According to Experian, the average rate on a new car loan in the second quarter of 2021 was 4.09%. For super-prime borrowers (those with sterling credit), the average rate dropped to 2.34%. But for deep subprime borrowers (those with poor credit), it climbed to 14.59%. Shoppers with good credit have more leverage to find a favorable rate.

3. Focus on the Out-the-Door Price

It can be tempting to zero in on the monthly car payment or the vehicle's MSRP, but to keep more money in your pocket, the all-in amount you're paying should be the primary focus. Consider how that breaks down between the price of the car, financing costs, dealer fees, state and local taxes, and any other add-ons.

"You can negotiate everything if you bargain in out-the-door terms rather than haggling over line-by-line charges about doc fees and paint protection," Bradley said. "At the very least, it doesn't hurt to make a reasonable out-the-door offer — the price of the car including fees, registration and taxes — as a way to start the process and establish terms for negotiation."

Bradley suggests looking for savings the dealer doesn't control, such as factory rebates, low-interest financing, loyalty, conquest programs, and deals for family and friends.

"Dealers may add extras such as wheel locks, paint protection, mudguards and anti-theft devices," Bradley said. "Find out early what is included in the quoted price, and whether the deal hinges on you paying for them. One dealer may insist; another may not."

Why should you avoid discussing your desired monthly payment with the dealer? First, you lose transparency on the real price of the vehicle you're buying. The car payment combines the price of the car with financing costs and other add-ons, minus the down payment and the trade-in allowance. All of that muddies the waters on the actual vehicle cost. What's more, a lower car payment doesn't necessarily translate to savings. A long-term auto loan can reduce the amount of your monthly payment, but it increases how long you'll be making those payments, tacking on additional interest that can add thousands of dollars over the course of the loan.

More From Cars.com:

- How to Win the Car Financing Game

- Car Shoppers Face Shorter Supply, Rising Prices

- Buying a Car During COVID-19: Car Deals & Advice

- Inventory Pinch: 25 Models Still Out There

- com Car-Buying Tips

4. Go Electric

The number of new electric vehicles on the market has increased substantially in the past few years. Buying a pure EV or plug-in hybrid can offer thousands of dollars in savings by way of federal tax credits, though you may have to wait until tax-return season — and consult with a tax advisor — to reap them.

Although the credits for automakers like Tesla and GM have expired, there are still plenty of eligible options — among them the Chrysler Pacifica Hybrid, Ford Mustang Mach-E, Jeep Wrangler 4xe, Kia Niro EV, Nissan Leaf, Toyota RAV4 Prime and Volkswagen ID.4. In addition to the $7,500 maximum federal tax credit, an electric vehicle can save $6,000 to $10,000 in ownership costs over the life of the vehicle, according to a Consumer Reports study.

A full list of EVs eligible for the federal tax credits can be found on the Department of Energy's website.

5. Get the Most Bang for Your Trade-In

While the news of soaring vehicle prices and supply shortages won't exactly encourage prospective buyers, those who have a vehicle to trade in may be in for a pleasant surprise. Amid the shortage of new vehicles, used-car values are on the rise.

Experian's State of the Automotive Finance Market report shows used-car values in the second quarter of 2021 rose to an average of $24,815; that's an increase of 25% compared to the second quarter of 2020, and more than 30% over 2019.

A generous offer for your trade-in can help offset some of the cost of a new vehicle purchase. Before you go to the dealership, research the fair market value on your trade, get multiple offers from dealers or groups like CarMax and prep your vehicle for sale to the dealer. If the dealership offers a lower trade-in value than you expected, use the other offers as leverage to get more for your trade.

Cars.com's Editorial department is your source for automotive news and reviews. In line with Cars.com's long-standing ethics policy, editors and reviewers don't accept gifts or free trips from automakers. The Editorial department is independent of Cars.com's advertising, sales and sponsored content departments.

How Much Will Car Salesman Come Down in Price

Source: https://www.cars.com/articles/inventory-shortage-leaves-little-room-for-haggling-here-are-5-other-ways-to-save-on-your-car-purchase-440288/

0 Response to "How Much Will Car Salesman Come Down in Price"

Post a Comment